US Inflation Hits 2.7% in November: Economic Growth Slows

US Inflation Reaches 2.7% in November 2023: What It Means for the Economy

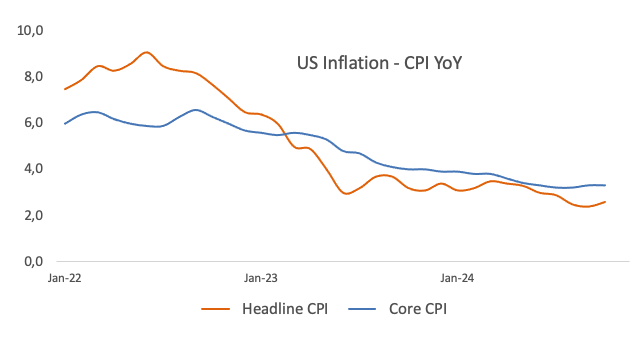

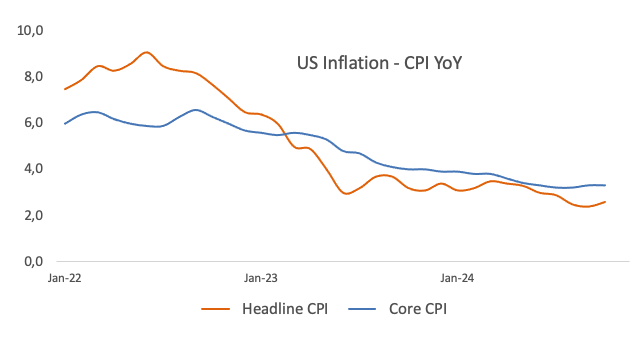

In November 2023, US inflation rose to 2.7%, marking a slight increase from previous months. This uptick is a significant economic indicator, suggesting changes in consumer prices that may influence both the Federal Reserve’s decisions and the broader economic outlook. Inflation, which reflects the rate at which prices for goods and services rise, directly impacts the cost of living and purchasing power for consumers.

For months, inflation in the United States had been on a steady decline, but the November figure shows that economic conditions might be changing. The 2.7% inflation rate is still considered moderate compared to the peak levels experienced earlier in 2022. However, it remains higher than the Fed’s long-term target of around 2%.

Key Factors Behind the Increase in Inflation

The rise in US inflation can be attributed to a number of factors, including higher energy prices, rising wages, and increased demand in certain sectors. Gas prices, for example, have seen a notable rebound after falling earlier in the year. Additionally, supply chain issues in certain industries continue to drive up costs, contributing to the overall inflation figure.

Another factor influencing inflation is the labor market. As wages increase, businesses may pass on these higher costs to consumers in the form of price hikes. The housing sector, too, has played a role, as home prices have continued to climb in many parts of the country.

What the 2.7% Inflation Rate Means for Consumers

For consumers, the rise in US inflation means that goods and services will become more expensive. While the 2.7% increase is moderate compared to past inflationary spikes, it still affects household budgets. Everyday items like food, transportation, and healthcare are becoming more costly, putting pressure on family finances.

Moreover, inflation impacts savings and investment returns. As inflation rises, the real value of money decreases, affecting long-term savings and investment portfolios. The increased inflation rate also signals that the Federal Reserve may adjust its monetary policies, potentially raising interest rates to control inflation and stabilize the economy.

Federal Reserve’s Response to Rising Inflation

The Federal Reserve has been closely monitoring inflation trends. Following a series of interest rate hikes in previous years, the central bank had hoped to bring inflation back down toward the 2% target. However, with US inflation at 2.7% in November, the Fed may reconsider its stance.

If inflation continues to rise, the Federal Reserve might be forced to implement further rate hikes. This could have a ripple effect on borrowing costs, impacting everything from mortgages to credit card interest rates. Higher interest rates generally cool down economic activity by making borrowing more expensive, which could help bring inflation back under control.

Inflation and the Broader Economic Outlook

The rise in US inflation in November comes at a time when many analysts were hoping for a more stable economic environment. The US economy is showing signs of slowing growth, with lower consumer spending and cautious business investment. While inflation remains below its 2022 highs, the November increase suggests that economic challenges are far from over.

The situation is complicated by ongoing global issues, such as supply chain disruptions and geopolitical tensions. These factors add uncertainty to the economic forecast, making it difficult to predict whether inflation will continue to rise or stabilize in the coming months.

Conclusion: The Road Ahead for the US Economy

As the US inflation rate hits 2.7% in November, it’s clear that inflation remains a key economic concern. While the increase is not drastic, it is a reminder that inflationary pressures still exist in the economy. Consumers and businesses will need to adjust to these changes, while the Federal Reserve will likely continue its efforts to manage inflation through monetary policy.

Looking ahead, the US economy faces a challenging road. The Federal Reserve’s next steps, as well as broader economic factors like consumer demand and global conditions, will play a critical role in shaping the inflationary landscape in the months to come.